The burst of the supply side economic bubble

Everybody is worried about a recession that will cause a decline in the market because of layoffs leading to reduced spending leading to reduced earnings, etc. But that is not what drives markets. We’ve observed below trend economic growth for more...

[Read Full Post]

The telltale sign gives us confidence in our short term bullish thesis

Reinvestment flows worked in reverse this year and paired with tax loss selling flows can be very significant into the EOY and BOY. That being said, the market handled it very well given the vol compression flows...

[Read Full Post]

Santa Rally is likely cancelled this year

The world is long 450T in assets. When the market is up on average 10% a year, the world gets 45T reinvested. Perhaps 10% of that comes back in the market on the first day of January, so along with flows due...

[Read Full Post]

Top of the book liquidity

The bastion of liquidity, the place where the world comes to hedge, the 10,000lbs gorilla maintaining world peace, is seeing the thinnest liquidity ever recorded. This is a long term warning sign as other places are incredibly volatile. The depth of the market is...

[Read Full Post]

1 step forward, 2 steps back

It is common knowledge at this point that positioning is very short (like, record short). This year has been a tug and pull between bearish macro flows and positioning underpinning the market and compression of vol. We continue to expect more stair steps...

[Read Full Post]

Don’t fight the fed

As the S&P and other markets rallied 20% off their lows since late June, we’ve gradually forgotten the mantra: don’t fight the fed. As 10Y yield is sitting at 2.8%, 2.5% below trim CPI and trimmed PCE deflator (running 4-6%), William Dudley, ex-ny fed chair,...

[Read Full Post]

Equities index is the last bastion of liquidity in the market. There is no liquidity in the interest rate and bond space anymore. FX has lost all its liquidity and we’re seeing that in the movement in vol. Tech, crypto, credit spreads are also widening dramatically. So watch equity vol...

[Read Full Post]

Long term expectations of inflation remain high (1-3 year):

- Businesses start bringing demand forward (build inventory and hoarding). Spend more actively now knowing that things will be more expensive later

- Investors will borrow at the feds negative interest rates and buy anything that is pinned down as securing against...

[Read Full Post]

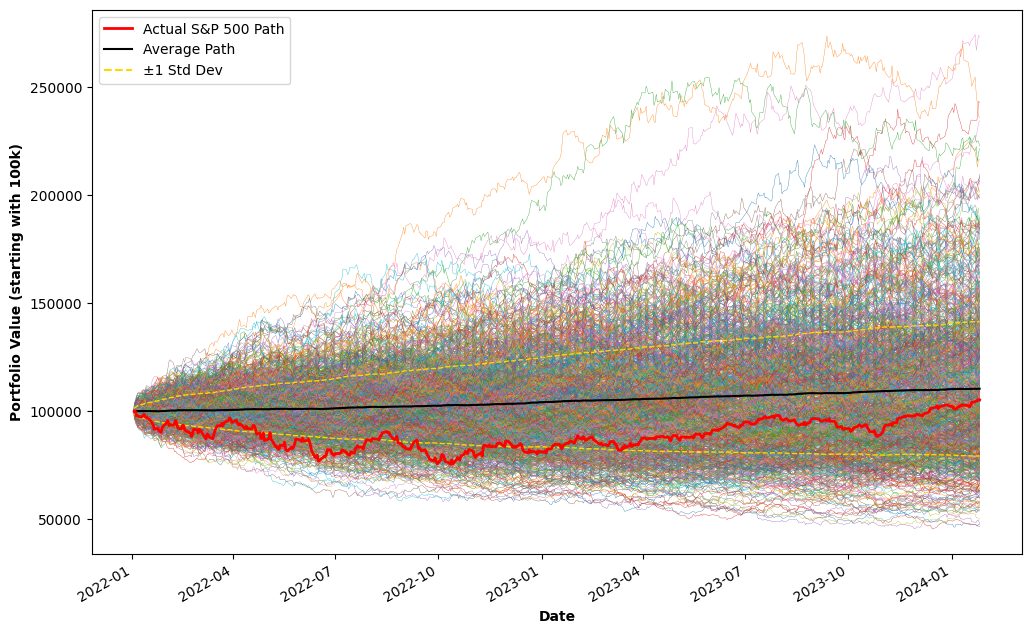

Back on October 25th 2021, we spoke about an eventual unhedged risk-on push to a blow off top kind of rally to end this 40 year long cycle. SPX 4800 was a very non-traditional top. Normally, due to the potential energy in the system at the end of a big...

[Read Full Post]

In an investigative foray into face mask detection utilizing YOLOv4, this study has successfully crafted a model with a mAP of 73.62% at an IoU threshold of 0.50. A comprehensive review of contemporary real-time object detection algorithms, including SSD and YOLO variants, established YOLOv4 as the preeminent choice in terms of speed and accuracy, even when juxtaposed with Google's EfficientDet and Facebook’s RetinaNet/MaskRCNN.

The model demonstrated exceptional proficiency in detecting correctly worn face masks, achieving an impressive mAP of 90.08%. It also showed reasonable effectiveness in identifying partially visible faces. However, the detection of improperly worn masks, colloquially termed 'chin diapers,' was less robust, a limitation attributed to the limited diversity in the training dataset. The study suggests that future enhancements could include the development of a more comprehensive dataset and the integration of advanced data augmentation techniques.

Crucially, the study underscores the importance of high accuracy in identifying individuals correctly wearing masks as they are the primary focus for admission into monitored spaces. The ability of the system to flag individuals not wearing masks or wearing them incorrectly is a pivotal feature, analogous to a security officer's role at the entrance.

[Read Full Post]